Ford partners with Redwood Materials to recycle EVs, and provide battery materials

The deal will see the automaker work with battery recycling firm Redwood to create an end of life solution for electric vehicles, reducing environmental footprint and future cost of manufacturing, while ensuring Ford has adequate supply to meet projected battery demand.

Ford’s EV architecture will soon use recycled battery components in a deal with Redwood materials. Image: Ford

Ford is partnering up with Redwood Materials with a plan to create a closed loop supply chain system for its future range of electric vehicles. Redwood Materials is the brainchild of former Tesla CTO JB Straubel, and the company wants to address the problems of growing e-waste by developing an end-of-life supply chain to provide materials to battery manufacturers and automakers.

According to a Redwood Materials media statement, “we [Redwood Materials] need to start planning now for the end-of-life of batteries as we ramp up to build millions of EVs that can’t be disposed of safely without a robust recycling solution. The exciting side of this problem is that the critical materials inside of a battery are essentially infinitely recyclable. Unlike gasoline, the materials are not consumed or lost in their lifetime of usage in the vehicle.”

Ford has already seen success with its Mustang Mach-E, and as the electrified F-150 Lightning enters pre-production, the automaker is sure to see battery cell and component demand soar over the short-to-medium term.

Battery modules used in Ford’s Mustang Mach-E, manufactured by SK Innovation. Image: SK Innovation

Redwood Materials currently partners with battery manufacturers such as Panasonic/Tesla in Nevada, and Envision in Tennessee. The company received a healthy $700 million capital injection in late July, through a successful fundraising round from the likes of Baillie Gifford, Goldman Sachs Asset Management, Amazon and more.

Redwood plans to soon supply anode and cathode materials back to the American supply chain, and the company states that the deal with ford will span a vehicle battery’s entire lifecycle. To further advance these business opportunities between the companies, Ford has invested $50 million in Redwood to help them expand their manufacturing footprint.

It’s positive to see Ford thinking ahead like this; while many automakers like Volkswagen and Stellantis are simply scrambling to build up battery capacity to meet growing demand, Ford’s long-term strategic partnership should provide the company with an opportunity to not only secure enough materials to meet production demand, but reduce costs of production, and the associated environmental footprint.

SEA Electric to purchase 1,000 battery sets from Soundon New Energy Technology Co for electric trucks

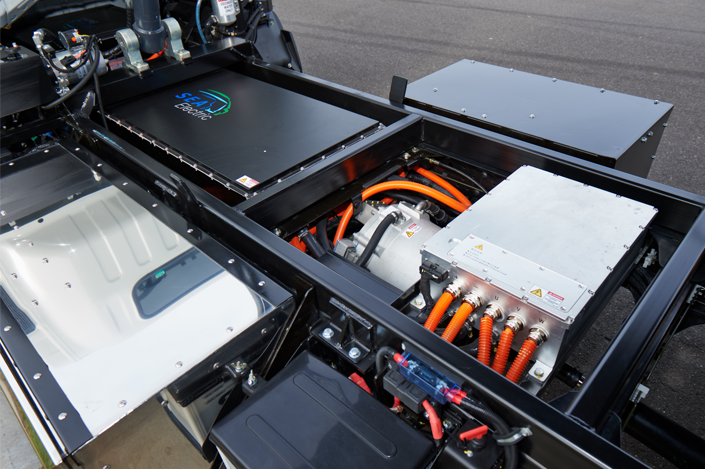

Global automotive technology company SEA Electric has expanded its global reach through the purchase of 1,000 electric vehicle batteries from long-time technology partner Soundon New Energy Technology Co. The newly formed arrangement immediately follows SEA Electric’s recently announced US$42 million in equity financing news.

Global automotive technology company SEA Electric has expanded its global reach through the purchase of 1,000 electric vehicle batteries from long-time technology partner Soundon New Energy Technology Co. The newly formed arrangement immediately follows SEA Electric’s recently announced US$42 million in equity financing.

Soundon has been providing SEA Electric with batteries since 2012, and the two companies have worked together closely on the development of seven SEA-Drive battery solutions over the course of the nine year relationship. SEA Electric is leveraging the cost benefits of Soundon’s battery and power electronics technical expertise, and their production efficiencies. The deal also allows SEA Electric to realise a significant 36 percent reduction in kilowatt hour (kWh) unit cost, and fulfilment of the battery production is expected to be completed in Q2 2021.

Soundon New Energy Technology’s manufacturing centre in China. Image: SEA Ealectric

According to Tony Fairweather, SEA Electric president and founder, Soundon is not only a world-class leader in innovation and battery technology, but highly regarded for its product quality, on time delivery, and competitive pricing. “Our long-term relationship with Soundon has been a very successful commercial journey and we anticipate continuing to share our global successes along the way.” While the majority of the initial 1,000 battery units are slated for the United States, the balance will go to SEA Electric inventories in Australia, New Zealand and Southeast Asia, along with the company’s first entry into the European market.

SEA Electric’s SEA-Drive technology fits hundreds of OEM platforms according to the company, with this large order from Soundon shared cross three major power-system models:

An Isuzu truck with SEA-Drive technology. Image: SEA Electric

SEA-Drive 70 – contains 88 kilowatt hours (kWh)

SEA-Drive 100 – contains 101 kilowatt hours (kWh)

SEA-Drive 120 – contains 138 kilowatt hours (kWh)

Wu Peng, Vice President of Sales and Marketing for Soundon commented that “this is a significant milestone in our partnership with SEA Electric. Receiving this 1,000-unit order not only facilitates SEA Electric’s substantial global growth, it also positions Soundon as a leader in the export market for commercial electric vehicles. It’s a winning proposition for all.”

With global headquarters and key leadership in Los Angeles, SEA Electric currently has operations in five countries and more than one million miles of independent Original Equipment Manufacturer (OEM) testing and in-service operation in all markets.

SEA Electric is an Australian success story, and currently partners with commercial vehicle OEMs, dealers, operators and upfitters to deliver zero-emissions trucks around the world. The company is expected to deliver more than 1,000 electric commercial vehicles this year. The company forecast is to have more than 15,000 vehicles on the road by the end of 2023.

Soundon New Energy Technology’s manufacturing centre in China. Image: SEA Ealectric

An example of SEA Electric’s SEA-Drive unit for OEMs. Image: SEA Electric

Vietnam's VinFast discussing potential EV battery and components deal with Apple supplier Foxconn

Vietnam's largest conglomerate Vingroup confirmed on Friday that its automotive subsidiary VinFast was in early stage talks with the Foxconn Technology Group about working together and that any partnership formed would focus on developing batteries and electric car parts.

Foxconn’s EV platform at a company event in 2020. Image: Reuters/Yimou Lee

Vietnam's largest conglomerate Vingroup confirmed on Friday that its automotive subsidiary VinFast was in early stage talks with the Foxconn Technology Group about working together and that any partnership formed would focus on developing batteries and electric car parts.

"Vingroup has received proposals from Foxconn but nothing is concrete yet. The partnership, if any, will focus on developing the batteries and electric car parts," a spokesman for Vingroup said. "No decision on working together to produce EVs has been made yet."

The flagship EV VinFast VF33 concept.

According to Reuters, Foxconn has put forward a proposal to VinFast to acquire their EV production lines, However VinFast would prefer a partnership as it remains keen to keep and grow its EV business.

Foxconn naturally declined to comment, however chairman Liu Young-Way also stated that the company may consider producing electric vehicles at its Wisconsin, USA plant, or look to setting up production facilities in Mexico. Liu described Foxconn as the "new kid in town" for vehicle manufacturing, and said the company needs to quickly build up its capacity to earn trust from clients.

Foxconn has been the world’s largest contract manufacturer for OEM’s for a few years now, and has openly stated that it has ambitions to shake up the automotive industry, but offering startup and established players alike a shortcut to competing in the electric vehicles market.

There’s no reason to expect that this can’t happen; Foxconn has moved quickly to establish deals with companies like Fisker and Byton. Recently Foxconn successfully established a deal with Zhejiang Geely Holding Group to provide contract manufacturing.

The VinFast LUX SA2.0 designed by Pininfarina. Image: VinFast

The VinFast LUX SA2.0 Interior.

Vinfast is the automotive arm of Vingroup, Vietnam’s largest conglomerate consisting of 48 subsidiary companies across real estate development, retail services, education, network security, healthcare and of course automotive manufacturing. The group has a combined estimated 50,000 employees, and a turnover in 2019 of 100 trillion VND - approximately $4.3 billion USD. Vinfast recently set up a research and devlopment arm in Australia, based in Melbourne.

The company sold around 30,000 vehicles in 2020, and plans to increase that by 50% in 2021. VinFast’s electric vehicle offerings are expected to begin hitting the domestic Vietnamese market by December 2021.

Source: Automotive News

Energy Renaissance announces start of construction for Australia's first lithium-ion battery factory

Australia will soon be producing lithium-ion batteries onshore, thanks to start-up Energy Renaissance. With funding raised exclusively from private investors, Energy Renaissance has committed to manufacturing batteries at a site in Tomago, NSW, only a few kilometres from the Port of Newcastle.

Australia will soon be producing lithium-ion batteries onshore, thanks to start-up Energy Renaissance. With funding raised exclusively from private investors, Energy Renaissance has committed to manufacturing batteries at a site in Tomago, NSW, only a few kilometres from the Port of Newcastle.

Energy Renaissance’s 4,500 sqm purpose-built facility will manufacture Australian made batteries that are, according to the company “safe, secure, affordable and optimised to perform in hot climates.” Energy Renaissance will be manufacturing energy storage systems for the transport industry including busses and light commercial vehicles, as well as batteries for grid-scale, mining industry and community storage uses.

Energy Renaissance will have an initial battery production capacity of 48MWh per year and the capacity to expand to 180MWh per year in 2022. Energy Renaissance’s long-term plans are to develop a 1GWh battery manufacturing facility, and potentially grow to 5.3GWh over the next decade.

Construction of the facility will commence in April 2021 with a small-scale production trial run of batteries to start by July 2021, ramping up to full-scale production in October 2021.

CIS Solutions recently undertook an independent economic impact analysis, and concluded that an Australian advanced manufacturing industry supplying and exporting battery-grade chemicals and materials would create over 100,000 construction and 80,000 operational jobs and add AUD$7.3 trillion in export revenue. (Note that we haven’t been able to find a link to this study online)

There has been a dramatic decline in appetite for Australian iron ore and coal both domestically and internationally, and the Australian Government has been rather slow in realising that lithium—a metal found in abundance in Australia—has the potential to not only generate serious export dollars as global demand for batteries rises over the next decade, but to also shore up skilled manufacturing jobs locally, assisting the transition and retraining of mining sector workers.

Energy Renaissance is perfectly placed to take advantage of this; it’s investment to process raw materials locally in a region already known for mining means that the company should have a captive employment market available, as well as access to global markets via the nearby port.

With the New South Wales committing to purchase over 8,000 electric buses, this should present a great opportunity for Energy Renaissance to find local customers.

The government’s Minister for Industry, Science and Technology Karen Andrews and the Prime Minister, Scott Morrison were also present at Energy Renaissance’s manufacturing facility launch, and were keen to jump in with their own announcement, releasing the Resources Technology and Critical Minerals Processing road map in the Commonwealth Government’s Modern Manufacturing Strategy.

The Strategy has the following goals:

2 years: Improved capability to bring products quickly to market, through improved market development activities and investment made in critical enablers.

5 years: Foster increased collaboration with relevant sectors and international supply chains, increase exports and grow private sector investment.

10 years: Australia seen as a regional hub for resources technology and critical minerals processing, with significant R&D advancements, retention in intellectual capital for SMEs and significant volume and value of exports.

We’ll keep you updated as Energy Renaissance’s facility comes together.

Read more about the government’s strategy here: https://www.industry.gov.au/data-and-publications/resources-technology-and-critical-minerals-processing-national-manufacturing-priority-road-map

500MW Battery Storage Project by Neoen Planned for Australia

Following the success of Neoen’s first battery storage project in Australia, as well as plans for battery storage combined with renewables projects in the Australian Capital Territory and Victoria, the company has submitted a scoping report with the appropriate NSW Government agency, outlining the importance of this large battery project as part of the Central-Orana Renewable Energy Zone (REZ)

Rendering of the 500MW Western NSW Battery Energy Storage System. Image: Neoen

Following the success of Neoen’s first battery storage project in Australia, the Hornsdale Power Reserve, as well as plans for battery storage combined with renewables projects in the Australian Capital Territory and Victoria, the company has submitted a scoping report with the appropriate NSW Government agency, outlining the importance of this large battery project as part of the Central-Orana Renewable Energy Zone (REZ) located about 100km west of Sydney, the first of the NSW government’s Renewable Energy Zones planned to drive the state towards zero emissions power generation.

According to Neoen’s scoping report, “The large-scale Battery Energy Storage System (BESS) that would be delivered by the project would operate unlike any other device currently connected to the NSW network, and would provide a range of services with extremely fast response times to support a stable network and security of supply. The energy storage capacity provided by the project would allow for increased installation of renewable energy sources while maintaining network stability and security,”

The battery could be operational by 2023, and would be built near the site of the 1,000MW Wallerawang coal power station that was mothballed in 2014. Neoen says that the new battery would provide additional energy system support services including frequency control, and would utilise some of the infrastructure that was used by the former coal plant.

Tesla Launches Model Y in China with MY2021 Upgrades and Sharp Pricing

Tesla Model Y orders are now open in the Tesla China Design Studio, priced from 488,000 yuan ($68,500 USD) for the Model Y Long Range, and 535,000 yuan ($75,200 USD) for the Model Y Performance.

Tesla Model Y orders are now open in the Tesla China Design Studio, priced from 488,000 yuan ($68,500 USD) for the Model Y Long Range, and 535,000 yuan ($75,200 USD) for the Model Y Performance.

According to Tesmanian, sources within Tesla China indicate over 100,000 orders were received upon release of the pricing information, and the company had to post an update on an update on Weibo stating the following:

"CURRENTLY, THERE ARE TOO MANY ORDERS ON THE OFFICIAL WEBSITE AND MAY NOT BE REFRESHED. PLEASE BE PATIENT."

While cheaper than expected, The Model Y’s main competitor is expected to be the NIO ES6, which starts from 358,000 yuan in China. The Model Y has also received some updates for the 2021 model year, including the revised centre console also seen on US-made Model 3s, new wood trim on the doors and an integrated wireless phone charger.

There’s currently no update regarding Australian pricing or delivery information for the Model Y, but as the China rollout — and the Model 3 Australian rollout — has demonstrated, Tesla often waits until the last minute to open the online design studio for the newest vehicles.